No, you don't need to create a user account; this way, everything is more convenient and faster.

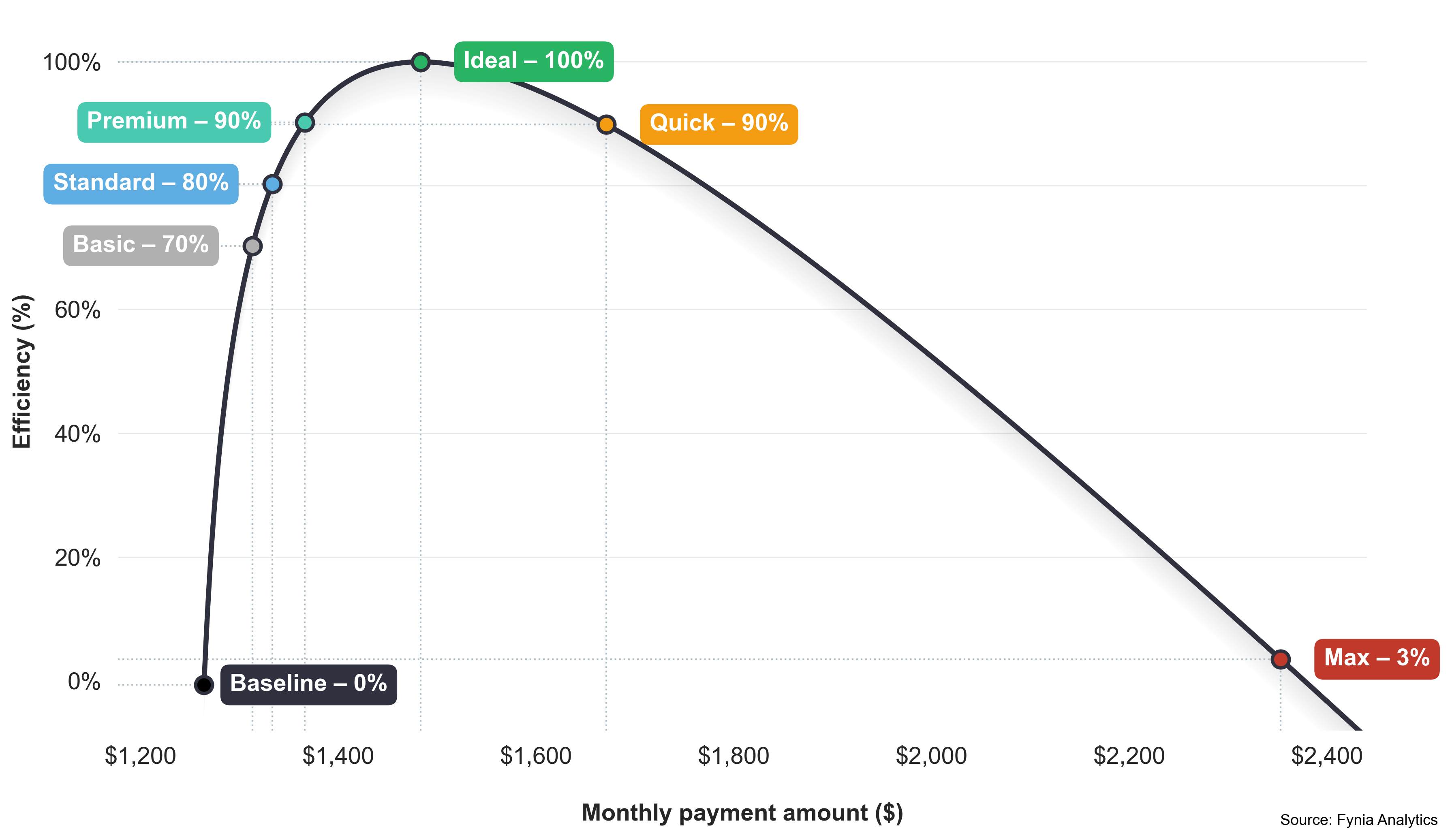

Discover Fynia, a cutting-edge platform that leverages advanced mathematical models and algorithms to pinpoint the optimal monthly payment values, making your loan repayment as efficient as possible